In Part 1 of this series, I suggested that consumer systematic trading is undermined by inferior technology and data. The gulf between the tools used by the financial elite and retail traders is wide, and may be widening over time. In this article we’ll continue our exploration with a survey of the products and platforms that are out there.

This isn’t a niche activity - estimates of the number of consumers involved are somewhere between 50 and 100 million people globally. Popular markets are currencies (FX), crypto, stocks and futures.

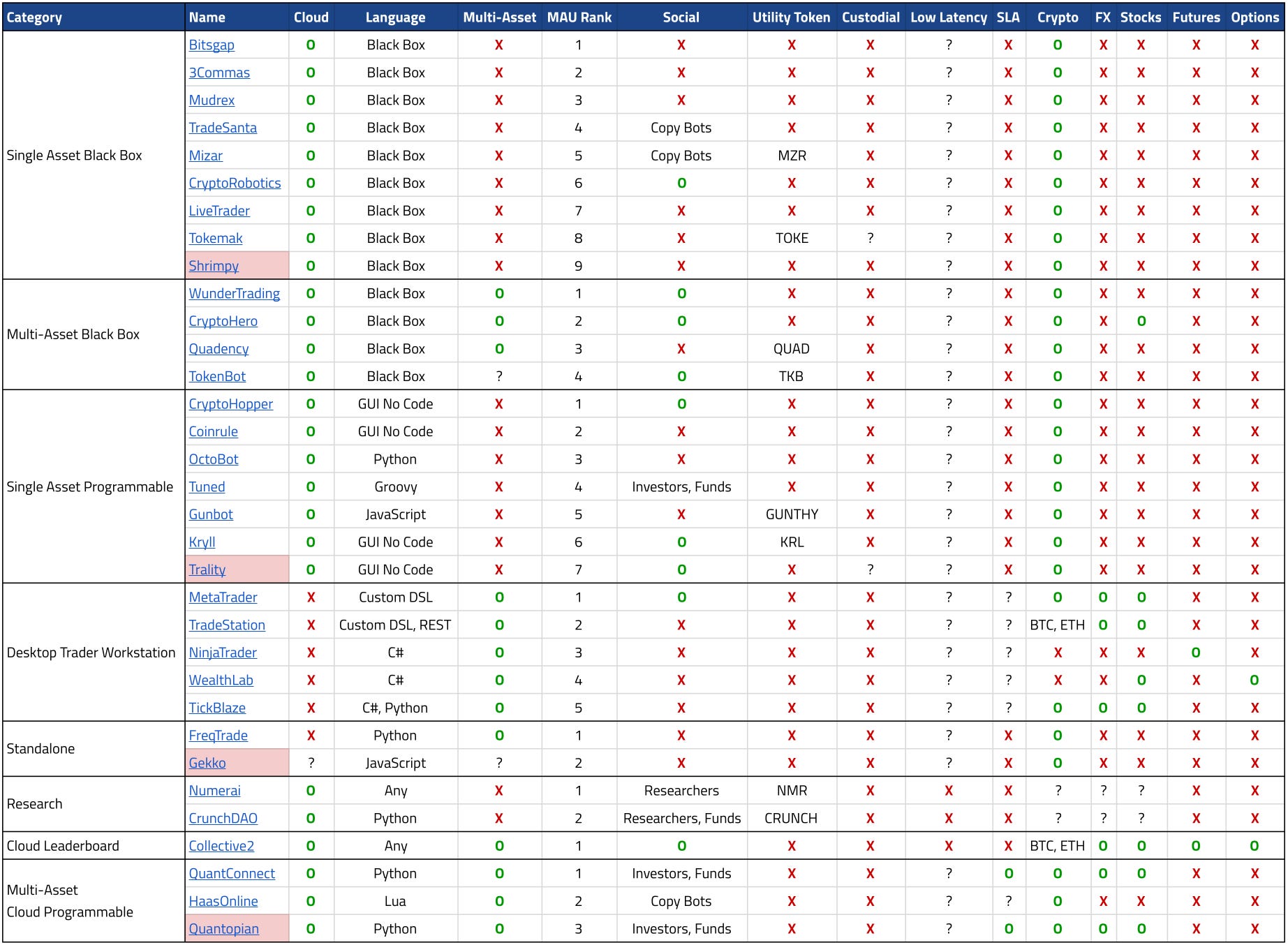

In researching the products that are out there, first I needed to curate a list. This survey proved to be a lot more challenging than I expected. Despite extensive online research, every time I spoke to a practitioner in the field, I discovered a new product. Maybe Google really should go back to pagerank. I ended up with 30 products (!) in the space, and I’m sure I’m still missing a few. Anyway, without further ado:

The Roundup

First, a big disclaimer: This information was gleaned from careful scrutiny of public information about product features and APIs. I did not evaluate actual usage of all 30. If I got something wrong, or you know of a product I should have included, please let me know in the comments! The red highlighted products have shut down, and are included for completeness.

The Categories

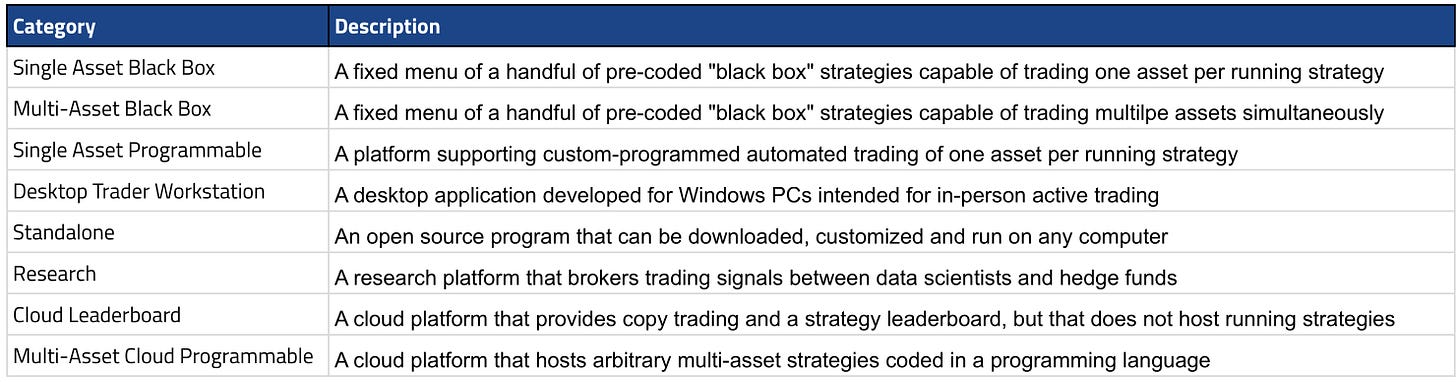

Here’s a summary of the categories I identified. At Psi Labs we’re on a mission to democratize systematic trading with a cloud platform that can run effective automated trading strategies for consumers. In discussions with active traders, various products came up that, for one reason or another, don’t really work for consumers looking to adopt a cloud platform, but they’re included here regardless.

Why Multi-Asset?

Why distinguish “single asset” from “multi-asset”?. Multi-asset strategies require the co-ordinated trading of multiple assets instead of just trading in and out of a single asset. The majority of effective systematic trading is multi-asset, including strategies like pairs trading and triangular arbitrage. Single-asset products aren’t capable of this.

First, let’s cover the research platforms, the cloud leaderboard, the standalone programs that are intended for software developers and the trader workstations.

Research Platforms

I’ve included a couple of research platforms - Numerai and CrunchDAO. These platforms act as intermediaries between data scientists and hedge funds, running tournaments and leaderboards for the best predictors and brokering their predictions. Effective predictors are rewarded by the investors who use their predictions. Neither of them actually host running trading strategies. These came up in a few discussions.

The Cloud Leaderboard

Collective2 is a very interesting copy trading platform in its own category, and I’ll cover it in a subsequent article on copy trading. It doesn’t host running strategies and it doesn’t distinguish manual screen trading from automated trading. It does host a leaderboard and permits anyone to allocate funds to successful strategies.

Standing Alone

This is a category of automated trading programs that are open source and can be downloaded and run by software developers. There are probably hundreds or thousands out there, but I’ve included a couple of the most well-known crypto products in the table. Gekko (good name!) shut down, but FreqTrade has an active community. These are really intended for software developers with strong conviction in the quality of their code - for example FreqTrade is written in Python and can be customized by the end-user.

Trader Workstations

… which brings us to the most popular tools for automated trading by individuals - trader workstations. These products are actively maintained but originate quite some time ago, and none of them are cloud-native. MetaTrader (MT5, Windows, 2010), TradeStation (v9.5, Windows, 2016) and NinjaTrader (v8, Windows, 2016) have millions of users.

Trader workstations are desktop computer applications primarily intended for screen trading - generally speaking they are intended to assist in-person trading by individuals, not to be left running unattended in a data center. However they’re programmable by end-users and can run automated trading, and there are active marketplaces for strategies that run on them.

Black Boxes

… back in the cloud, a large number of products are “black boxes”. With black boxes, you can’t create arbitrary trading strategies at all. In programming, a black box is software whose code isn’t disclosed and can’t be inspected or modified. Out of 20 cloud platforms that actually host running strategies, 11 host a fixed menu of a handful of black box strategies.

Grid trading and dollar-cost-averaging (DCA) strategies are very popular menu items, recurring frequently. A number of crypto exchanges also offer these (I didn’t include crypto exchanges in the survey). Neither strategy would be my first choice, and it’s curious that these styles of investing have become so predominant. To my knowledge, institutional prime brokers do not offer them. The earliest description of grid trading that I could find was in Llewelyn James’ book from 2005. I suspect that grid trading carries a very high risk of over-trading, generating lots of trade commissions for brokers and crypto exchanges. Dollar cost averaging is an old idea that pre-dates the Internet. The closest modern institutional equivalent to DCA that I can think of is TWAP (time-weighted average pricing), which is usually disdained in favor of VWAP (volume-weighted average pricing). Disagree? Let me know.

Cloud Automated Trading Platforms

… so let’s eliminate the desktop trader workstations, the black boxes, the standalone programs, the platforms that are limited to single-asset strategies and the various products that don’t actually run trading strategies at all. Two are left in the running for cloud platforms that are capable of running multi-asset trading strategies - QuantConnect and HaasOnline (Quantopian has shut down).

Discerning consumers of automated trading will want some sort of service-level agreement (SLA) to assure reliability and availability. They’ll also probably want access to more than just one asset class, ideally coverage of several including FX, crypto and stocks. Strategy authors will want to express their strategies in a high-performance mainstream programming language with a large active ecosystem… And anyone wanting to use latency-sensitive strategies will want low-latency. Applying those requirements to the field, QuantConnect is the last one standing, although low latency is a question mark.

The Gulf

If you were running a multi-strategy hedge fund engaged in systematic automated trading 24x7, would you use most of these products? What would be missing? Not a complete list, but trading cost analysis, real-time P&L and pre- and post-trade risk management jump right out at me.

It’s basically irresponsible to trade blindly on signals without key guard rails - accounting for trading costs, slippage, market impact, unrealized and realized P&L, trading power, inventory and the various risks intrinsic to active trading including liquidity and concentration.

An ideal consumer product would provide those guard rails. To be fair, some of the trading strategies out there do provide some of these protections, but there is a woeful lack of transparency and open discussion of these risks.

Next Up

In part 3 of this series I’ll be diving into latency and slippage, which are key to effective trading performance.

Thanks to a roundup at https://blockonomi.com/bitcoin-trading-bots/ by Andrew Norry, I found a few more crypto products that were missed in the first version of this article: Mizar, Exchange Valet (shut down), CryptoTrader (shut down), Zignaly (aka ZigDAO - no bots just copy trading), Apex Trader (shut down), Cap.Club (shut down), Signal Groups (shut down), Live Trader and Zenbot (standalone, no longer maintained). These were mostly unsophisticated single-asset black boxes. I will add the live ones into the table and update the article.