TLDR

Collective2’s platform shares some key characteristics with the Psi Arena product - in particular being non-custodial, the capital allocation and the strategy leaderboard. But there are some very significant differences:

Comparison

Collective2 does not run strategies on-platform - instead it ingests trade flow from strategies running off-platform on trader workstations. Managers are strategy owners who are required to share their trades with collective2. Ingested orders are converted into buy and sell signals, and these are used to synthesize order flow for investors who are following (i.e. copying) the strategies. In this respect it is very similar to eToro, particularly since Collective2 makes no distinction between manual screen trading and auto-trading. More on how collective2 ingests trade flow below.

Collective2 relies on third party trader workstations to run strategies. They recommend QuantConnect, NinjaTrader, TradeStation, TickBlaze, and WealthLab. More on these platforms below.

Collective2 does not natively support crypto, although they do offer broker integrations, some of whom offer very limited crypto trading such as Interactive Brokers (who in turn use Paxos).

Collective2 is intrinsically unfit to run latency-sensitive strategies - the delays introduced by waiting for orders to fill, ingesting the trade, distributing, resizing and emitting copy order flow will be very large - probably several tenths of a second. To be competitive in crypto, latency from market data event to order transmission should be sub-millisecond.

Collective2’s platform is unfit for market-making or arbitrage (whether inter-market or triangulation).

Collective2’s revenue and rewards model is fixed-fee recurring. Typical strategies cost $50-150 per month. There is no requirement for strategies to be profitable for managers to earn rewards. $50 is a large amount for a small investor looking to try a new strategy with $100 or so.

There is no utility token or opportunity for capital appreciation in a utility token.

Psi Arena will offer historical data in time-series databases that can be used on the platform.

Psi Arena can systematically internalize order flow from multiple strategies and apply smart order routing.

Collective2 Integration Models

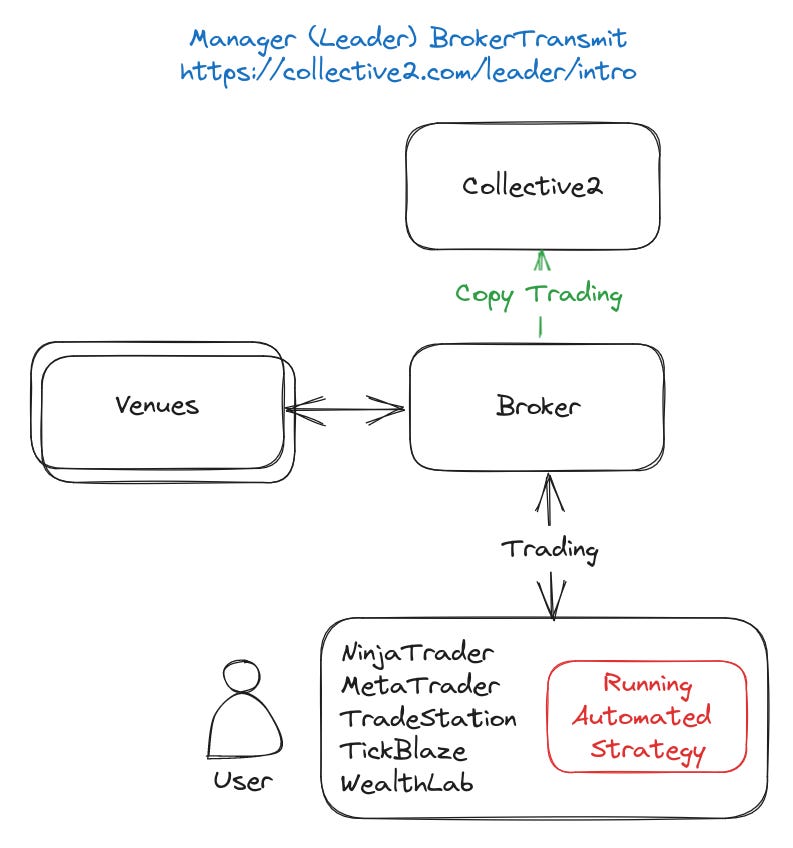

Collective2 Manager (Leader) BrokerTransmit

In this model, managers use their trader workstations to trade directly with brokers, and share API keys with Collective2 to permit them to copy their trades (details).

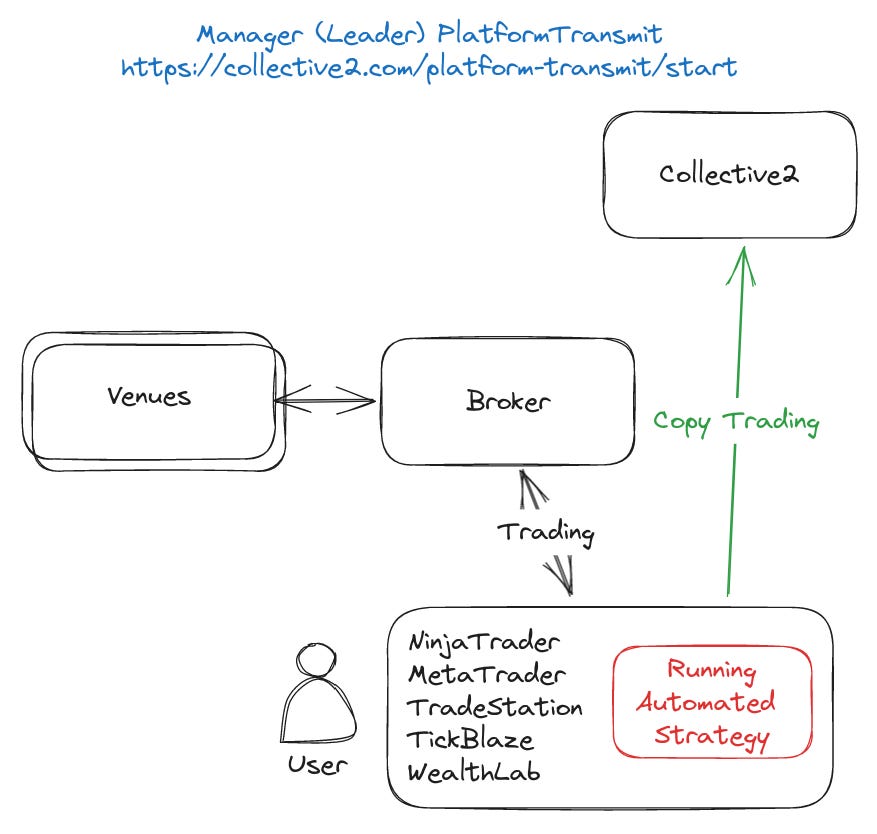

Collective2 Manager (Leader) PlatformTransmit

In this model, managers’ trader workstations copy trades to collective2 (details).

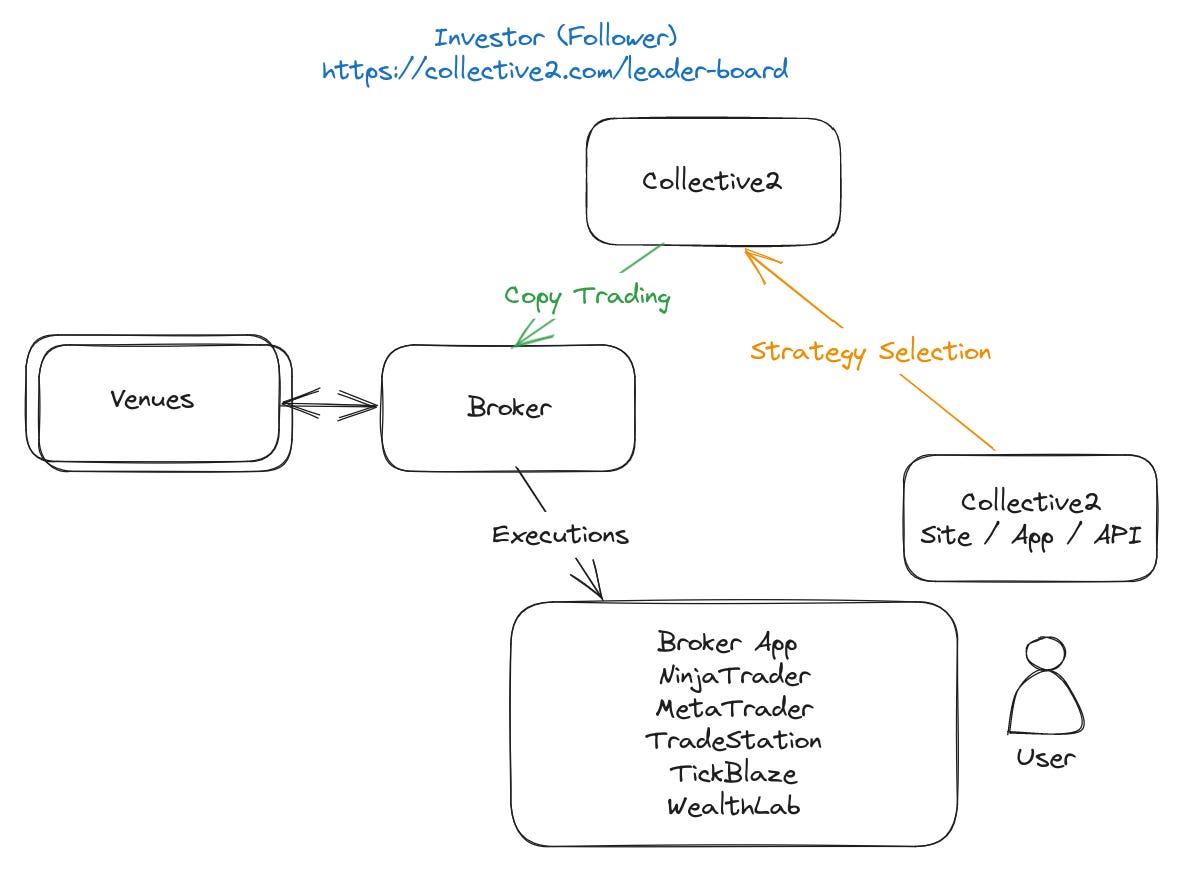

Collective2 Investor (Follower)

This shows how investors select strategies and collective2 initiates orders on their behalf, with the investor monitoring the activity via their broker app or trader workstation.

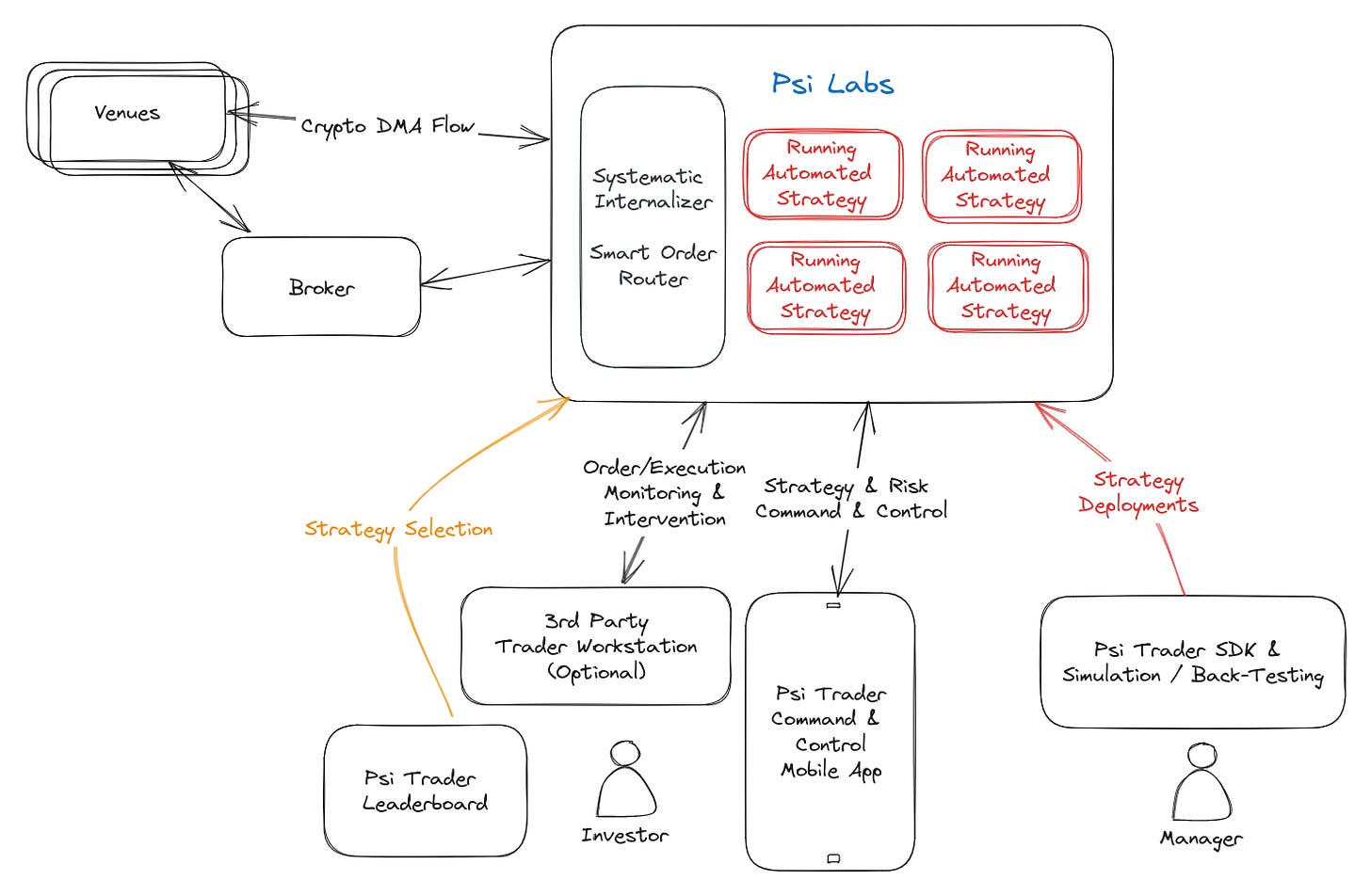

Psi Arena Integration Model

In the Psi Arena system, strategies run in a multi-tenant cloud platform. Because the platform is intermediating order/execution, it can take advantage of crossing opportunities (two strategies trading against each other), and systematically internalize. Strategies can also leverage smart order routing, which is of particular importance in crypto due to fragmented liquidity.

Trader Workstations Overview

All these products are Windows desktop applications and hard to run unattended 24x7.